Welcome to this week's Market Pulse! The shifting dynamics in our market tell an interesting story this week.

The market continues to show signs of softening amidst rising mortgage rates, likely driven by inflation concerns from proposed tariffs and strong stock market performance pulling investment from mortgage-backed securities. Let's explore this week's market data from RLAH @properties.

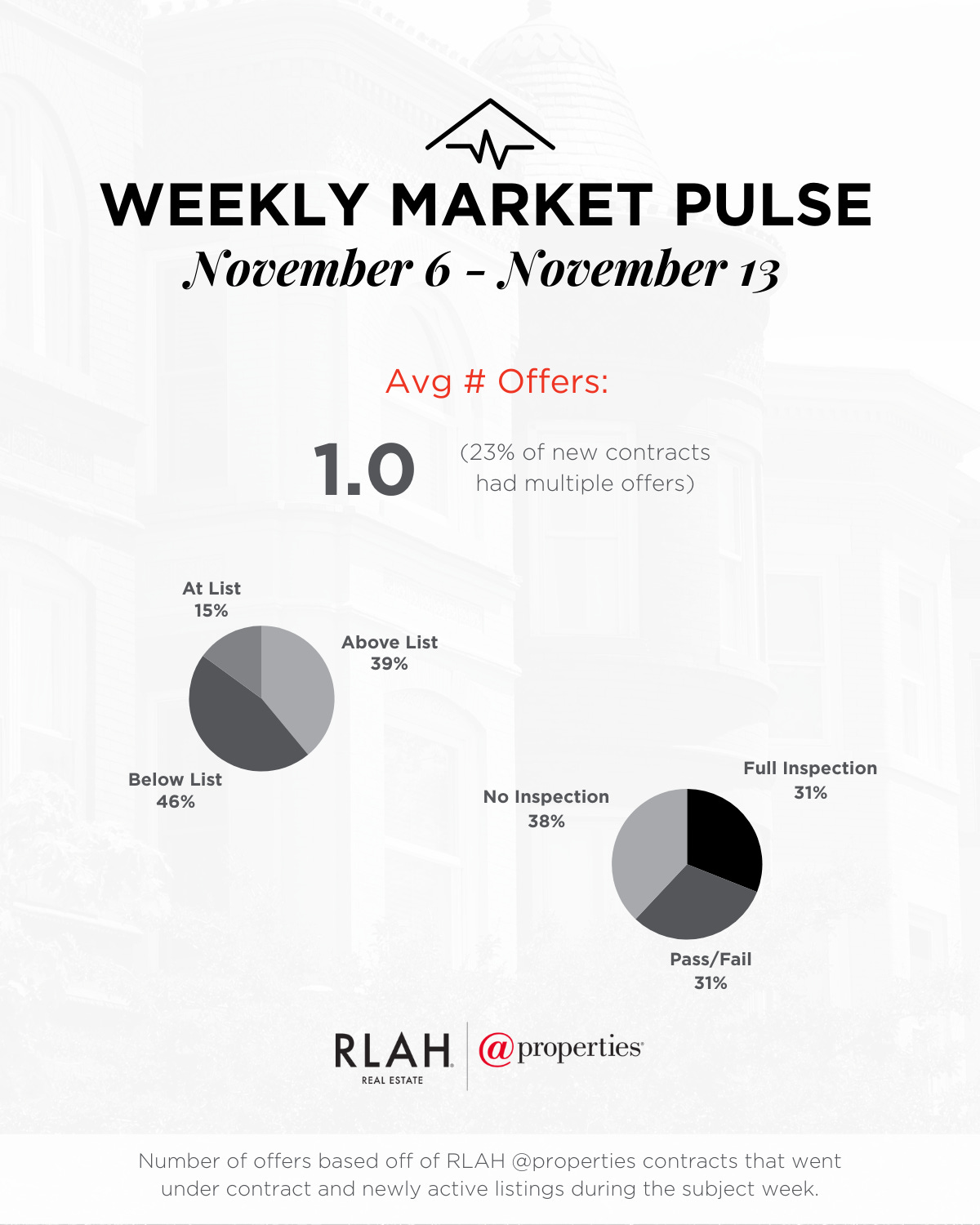

📊 Market Pulse: November 6 - November 13

Average Number of Offers: 1.0 (Up slightly from last week's 0.8, but only 23% of new contracts received multiple offers, down from 43%)

Offer Prices:

Above List: 39% (down from 43%)

At List: 15% (down from 57%)

Below List: 46% (up from 0%)

Inspection Trends:

Full Inspection: 31% (down from 43%)

Pass/Fail: 31% (up from 14%)

No Inspection: 38% (down from 43%)

🌡️ Market Analysis: This week's data reflects a clear market response to both seasonal patterns and broader economic factors:

Buyer Activity: While the average number of offers per property increased slightly to 1.0, the sharp drop in multiple-offer situations (23% from 43%) reinforces our market segmentation - certain properties still attract strong interest while others see limited activity.

Pricing and Offers: The return of below-list offers (46%) and decline in above-list offers (39%) reflects buyers responding to rising mortgage rates. This shifting rate environment, combined with seasonal patterns, is creating more negotiating room in many segments.

Inspection Trends: The balanced mix of inspection approaches (31% full, 31% pass/fail, 38% no inspection) further demonstrates our market segmentation, with strategies varying by property type and location.

📈 Market Implications:

For Buyers: The market is offering more negotiating opportunities, but rising mortgage rates are impacting purchasing power. Strategic timing and proper valuation are crucial.

For Sellers: Proper pricing is becoming even more critical as buyers gain leverage and face higher borrowing costs.

📅 Looking Ahead: While I was forecasting increased activity from pent-up buyer demand around Thanksgiving, the recent increase in mortgage rates is likely to stifle that momentum. For neighborhood-specific analysis and to understand how these trends affect your situation, check out the full Market Monday report or reach out directly: 301-564-3058 or Corey@FeldmanGroupRe.com

Share this post